Your credit score is more than just a number. It’s a snapshot of your financial health that affects everything from the car you drive to the home you buy. Knowing credit score ranges is key. Knowing this helps you make better financial choices, whether you’re getting your first credit card or refinancing a mortgage.. For tips on credit score improvement and financial future, check out more information.

This guide explains everything about credit score ranges, from poor to exceptional. It highlights how FICO and VantageScore models work, the key factors that affect your credit, and steps to improve it. Learn how to maintain good credit habits, monitor your score, and achieve financial stability.

According to Experian, the average FICO® score in the U.S. was 715 as of 2024.

Credit Score: What It Is & Why It Matters

Definition and Purpose

A credit score is a three-digit number. Lenders use it to see how likely you are to repay loans. Think of it as your financial report card. The higher your score, the more trustworthy you seem to banks, credit card companies, and other lenders.

Credit scores come from your credit reports. These reports track how you borrow and repay money. These reports are maintained by three major credit bureaus: Equifax, Experian, and TransUnion.By the end, you’ll know exactly where you stand and what steps to take next. For further guidance, see how to improve your credit score mindset as a freelancer.

The Impact: Loans, Interest Rates, and More

Your credit score influences several key areas of your financial life:

-

Loan approvals: A higher score increases your chances of getting approved for a mortgage, auto loan, or personal loan.

Interest rates: Borrowers with great credit usually get lower interest rates. This can save them thousands over the loan’s life

Credit card offers: Premium credit cards with rewards and perks typically require good to excellent credit.

Housing: Landlords may check your credit before approving a rental application.

Employment: Some employers check credit reports during hiring. This is common for jobs with financial responsibility.

Overview of Major Credit Scoring Models

the two maximum extensively used credit score scoring models are FICO and VantageScore. While they use similar data, their scoring ranges and weightings differ slightly. FICO scores are used in about 90% of lending decisions, making them the industry standard. VantageScore, created by the three major credit bureaus, is becoming popular. It offers a more inclusive way to score credit.

Both models aim to predict the same thing: how likely you are to repay debt on time.

According to MyFICO, most credit scores follow the 300‑850 range.

The FICO Score Range Breakdown

FICO scores range from 300 to 850 and are divided into five categories. Each range reflects different levels of credit risk.

Poor (300-579): Challenges and Consequences

A poor credit score signals significant financial difficulties. People in this range may have:

Multiple missed or late payments

High credit card balances

Accounts in collections

Bankruptcies or foreclosures

What it means for you:

Loan approvals are rare, and when they happen, interest rates are extremely high.

You may need a co-signer or secured credit card to rebuild credit.

Landlords and employers may view your credit negatively.

Fair (580-669): Room for Improvement and Limited Options

Fair credit means you’re below average but not in crisis. You might have a few late payments or high balances, but nothing catastrophic.

What it means for you:

You can qualify for some loans, but interest rates will be higher than average.

Credit card options are limited, and you may not qualify for rewards cards.

Improving your score from fair to good can open up significantly better opportunities.

Good (670-739): The Average and Acceptable Range

Good credit is the sweet spot for most Americans. It shows responsible borrowing habits and consistent payments.

What it means for you:

-

Most lenders will approve your applications.

-

You’ll get competitive interest rates, though not the absolute best.

-

You have access to a wider range of credit cards and loan products.

Very Good (740-799): Prime Borrowers and Better Deals

Very good credit puts you ahead of the curve. Lenders see you as a low-risk borrower with a strong repayment history.

What it means for you:

-

You qualify for loans with favorable terms and lower interest rates.

-

Premium credit cards with travel rewards and cash back are within reach.

-

Auto loans and mortgages become easier and cheaper to secure.

Exceptional (800-850): Elite Status and Best Rates

Exceptional credit is the gold standard. Only about 20% of Americans achieve scores in this range.

What it means for you:

-

You receive the lowest interest rates available on all types of loans.

-

Lenders may waive fees or offer special perks to earn your business.

-

You have maximum negotiating power when applying for credit.

The VantageScore Range Breakdown

VantageScore also ranges from 300 to 850 but uses slightly different categories. Here’s how it breaks down.

Poor/Very Poor (300-600)

This range indicates serious credit challenges, similar to FICO’s poor category. Borrowers here face limited access to credit and steep interest rates.

Fair (601-660): Improving Scores

Fair credit under VantageScore is slightly narrower than FICO’s range. You’re on the path to improvement but still considered subprime.

Good (661-780): A Strong Position

VantageScore’s “good” range is wider than FICO’s. It even covers what FICO calls “very good.”” This reflects solid financial habits and opens doors to better credit products.

Excellent (781-850): Maximizing Benefits

Excellent credit under VantageScore mirrors FICO’s exceptional range. You’re in the top tier and enjoy the best financial terms available.

How Are Credit Scores Calculated?

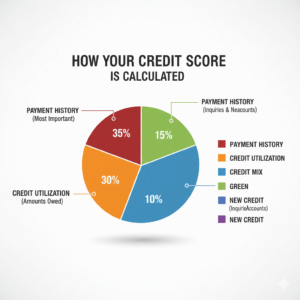

Credit scores are basedon five key factors.

Understanding these can help you take control of your credit.

Payment History

Your payment history accounts for about 35% of your FICO score. Lenders want to know if you pay bills on time. Missing just one payment can harm your score. But making payments on time builds trust over time.

Amounts Owed

Credit utilization is the percentage of your available credit in use. It accounts for about 30% of your score. For example, if you have a $10,000 credit limit and owe $3,000, your utilization is 30%. Experts recommend keeping utilization below 30%, and ideally under 10%, for the best scores.

Length of Credit History

This factor accounts for 15% of your score. The longer your credit history, the better. Lenders like to see a proven track record of managing credit responsibly over time.

Credit Mix

Credit mix makes up 10% of your score. It looks at the different types of accounts you have, like credit cards, auto loans, mortgages, and student loans. A diverse mix shows you can handle different types of credit.

New Credit

New credit accounts for 10% of your score. Opening several accounts quickly can signal financial trouble. This may temporarily lower your score. Hard inquiries from credit applications remain on your report for two years. However, they usually only affect your score for a few months.

How Can You Improve Your Score?

Improving your credit score takes time and discipline, but the payoff is worth it. Here’s how to raise your score based on where you are now.

Strategies for Raising a Poor or Fair Score

If your score is in the poor or fair range, focus on these steps:

-

Pay all bills on time: Set up automatic payments or reminders to avoid missed deadlines.

-

Pay down high balances: Reducing your credit utilization can boost your score quickly.

-

Dispute errors: Check your credit reports for mistakes and dispute any inaccuracies with the credit bureaus.

-

Consider a secured credit card: If you can’t qualify for traditional credit, a secured card can help rebuild your history.

Maintaining a Good or Very Good Score

Once you achieve good or very good credit, the key is to maintain it. Keep your credit utilization low, ideally below 10%, to show responsible credit usage. Avoid closing old accounts, as they help build a longer credit history.. Regularly monitor your credit score to catch issues early. Limit new credit applications to reduce hard inquiries. These habits will help you preserve and strengthen your credit over time. Regularly monitorMonitor your credit to catch issues early. Limit new credit applications to reduce hard inquiries. These habits will help you preserve and strengthen your credit over time. The Path to Exceptional

Reaching exceptional credit requires patience and consistency. Here’s what it takes:

-

Continue making every payment on time, without exception.

-

Keep your oldest accounts active to extend your credit history.

-

Diversify your credit mix if you haven’t already.

-

Stay vigilant about monitoring your credit and addressing issues immediately.

Your Credit Score Reflects Your Financial Habits

Your credit score is a powerful tool that shapes your financial future. To repair poor credit or keep a great score, follow these steps: pay on time, keep balances low, and stay informed.

Key Takeaways and Actionable Steps

Here’s what you need to remember:

-

Credit scores go from 300 to 850. Higher scores lead to better financial chances.

-

FICO and VantageScore are the two main scoring models. They both look at payment history, credit utilization, and other factors.

-

To boost your score, you need to put in steady effort. Even tiny changes can help.

Check your credit report for errors. Then, set up automatic bill payments. These simple steps can set you on the path to better credit.

Monitoring Your Score

You can get one free credit report each year from the three major bureaus. Many credit card companies also offer free credit score monitoring. Take advantage of these resources to stay on top of your credit health.

Knowing credit score ranges helps you feel confident when shopping for a loan or planning a big purchase. Your credit score is always changing, and with the right habits, you can take control of it.

FAQs

What are the different credit score ranges?

Credit scores range from 300 to 850. Scores between 670 and 739 are considered good, 740 to 799 very good, and 800+ exceptional. Lower scores indicate higher credit risk, while higher scores unlock better financial opportunities.

How does payment history affect my credit score?

Payment history makes up 35% of your score. Paying bills on time builds trust with lenders, while missed payments lower your score. Consistent, timely payments are key to maintaining good credit.

What’s the difference between FICO and VantageScore?

Both scoring models range from 300 to 850, but they weigh factors slightly differently. FICO is used in 90% of lending decisions, while VantageScore is newer and more inclusive.

How can I quickly improve my credit score?

To boost your score, pay bills on time, lower credit utilization below 30%, and avoid opening too many new accounts. Even small changes can improve your score in a few months.

Why is credit monitoring important?

Regular credit monitoring helps you track changes, detect errors, and prevent identity theft. Checking your score frequently ensures you stay aware of your financial health and credit progress.

Read Also:What Is a Credit Score and Why It Matters for Your Financial Future